In today’s insurance landscape, agility and scalability are more than just buzzwords — they’re prerequisites for staying competitive. As insurers adopt cloud-based solutions and other modern technologies, they can quickly adapt to market shifts, integrate with partner platforms, and externalize key functions like rating, underwriting, and digital experiences. Extreme automation can help carriers ensure their systems can grow alongside business demands.

By incorporating extreme automation into their business process testing (BPT), insurers can reduce bottlenecks and deliver a better experience to both customers and agents. Simply adopting cutting-edge platforms and externalizing core insurance functions isn’t enough; these systems must be continuously validated to maintain operational efficiency, compliance, and quality.

What Is Extreme Automation?

The complexity of property and casualty (P&C) insurance business processes, spanning everything from underwriting to distribution and claims, makes extreme automation a necessity rather than a luxury.

Extreme automation in BPT is the practice of automating every stage of the testing process — from generating test cases to executing and validating them — across the full range of systems and technologies involved. By minimizing human intervention, extreme automation ensures continuous validation of critical processes, helping insurers maintain operational efficiency, compliance, and high-quality standards.

When positioned within a quality engineering (QE) strategy, extreme automation becomes more than just a standalone solution. It complements continuous testing by bringing real-time analytics and rapid feedback loops into every product development phase. Rather than relegating testing to the end of the cycle, QE encourages automated checks for user experience (UX), APIs, and beyond. This integrated approach helps uncover errors and bugs early, enabling insurers to deploy new releases with greater confidence.

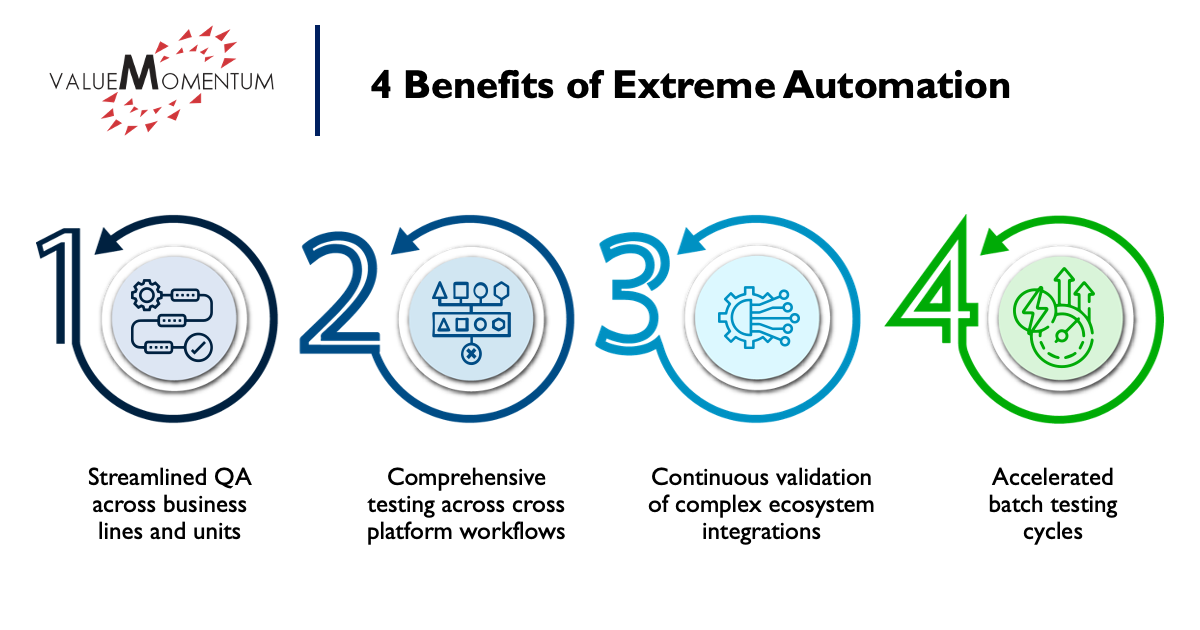

4 Ways Extreme Automation Helps Insurers

With the rapid rise of AI, cloud computing, and advanced analytics, insurers must adapt faster than ever to remain competitive. Extreme automation streamlines entire business workflows — from customer onboarding to billing — by integrating and exhaustively testing across multiple systems, reducing test execution times and accelerating time to market.

Extreme automation isn’t just a forward-thinking approach. It’s a practical necessity for insurers looking to stay ahead in a rapidly evolving industry. Here are four reasons insurers might need extreme automation:

1. It streamlines quality assurance across diverse lines of business and business units.

P&C insurance involves a broad range of lines of business (LOBs), ranging from personal lines to specialty lines to reinsurance, each supported by specialized applications for policy management, billing, and claims. One insurer could have hundreds of applications within its ecosystem, and ensuring consistent functionality and seamless integration across these systems is critical. Failures in these areas can lead to financial losses, compliance issues, and poor customer experiences.

Extreme automation addresses this complexity by enabling consistent, end-to-end testing across all LOBs. It validates business-critical processes for stability and quality, ensuring smooth operations even as systems interact across LOBs. This approach minimizes risk and supports insurers in delivering seamless, unified customer experiences.

For instance, an insurer offering a bundled product combining auto and home policies relies on system integrations to manage processes like unified billing or claims handling. Extreme automation ensures these workflows function without errors, helping carriers maintain high operational standards and customer satisfaction.

2. It ensures comprehensive testing across cross-platform workflows.

Modern insurance workflows span a diverse range of platforms and systems, encompassing both upstream and downstream processes. Functions like policy administration, billing, claims processing, commissions, and data reporting rely on interactions between 10 to 20 interconnected applications and touchpoints. These workflows also accommodate various role-based scenarios, such as those of agents, underwriters, and actuaries, while adhering to critical requirements like state and federal compliance, rating, and forms.

Extreme automation ensures comprehensive testing of these complex, cross-platform workflows. By automating the validation of end-to-end processes, it identifies and addresses issues that would be impractical to detect through manual testing. This approach delivers higher accuracy and efficiency, enabling insurers to maintain seamless operations across their ecosystem.

For example, in a claims workflow, extreme automation can validate interactions between claims management systems, billing platforms, and regulatory compliance modules, ensuring smooth processing and accurate reporting. By addressing these interdependencies, insurers can reduce errors, meet compliance standards, and improve overall operational reliability.

3. It can continuously validate complex ecosystem integrations.

The P&C insurance landscape depends on a vast ecosystem of interconnected enterprise applications and third-party integrations. Upstream systems such as Salesforce, Workday, and mobile platforms must seamlessly connect with downstream applications like commissions, tax reporting, billing data, and more. Additionally, critical integrations with third-party providers like CorVel, Snapsheet, LexisNexis, and E-Subro Hub further complicate the landscape.

Ensuring these diverse systems and integrations work cohesively is essential for smooth operations. Extreme automation plays a pivotal role in continuously validating these connections by rigorously testing data flows, system interactions, and end-to-end processes. This ensures accuracy, reliability, and functionality across the entire ecosystem.

For example, automating tests for a claims process might involve verifying how internal systems interact with Snapsheet for estimates or LexisNexis for fraud checks. By maintaining seamless integrations, extreme automation reduces errors and supports insurers in managing the complexity of their enterprise environments with confidence.

4. It accelerates necessary batch testing cycles.

Batch cycle testing is a critical yet highly manual and time-intensive process in insurance operations. It requires testing across multiple applications with thousands of data scenarios, running sequential batch jobs over several days, and relying on business teams to manually validate results across various systems. This process often spans a week or more, delaying defect fixes until all validations are completed and extending the overall release timeline.

The sequential nature of batch cycle testing introduces several challenges, including delayed feedback, higher risk of errors, and limited scalability. These inefficiencies increase operational costs and hinder timely defect identification, making it difficult to improve testing effectiveness and release schedules.

Extreme automation transforms this process by automating batch testing workflows, enabling simultaneous validation across applications and delivering faster, more reliable feedback. This ensures efficiency, scalability, and reduced cycle times, empowering insurers to address defects proactively and accelerate time to market.

Extreme Automation: The Key to Testing in Insurance

Extreme automation transforms insurance workflows by ensuring seamless integration and exhaustive testing across multiple systems. By reducing test execution times and automating repetitive tasks, it accelerates defect detection and release timelines while minimizing human error. This enables insurers to maintain high operational standards and adapt effortlessly to new functionalities as their business grows.

With continuous testing triggered by each code change, extreme automation provides real-time validation, early defect detection, and proactive issue resolution. By optimizing resource allocation and reducing reliance on manual testing, it improves cost efficiency while minimizing post-release defects. Insurers leveraging extreme automation can deliver better products faster, ensuring scalability, compliance, and long-term success in a competitive market.

Interested in learning more about automation’s role in testing? Check out our webinar, “QA Automation Testing Demystified” to explore how other insurers are putting automation at the center of their quality assurance journey.